Recently Ubidy had the pleasure of being invited to join a trade mission to Singapore and Malaysia and as a part of this trip, we noticed some fascinating aspects of the Singaporean labour market when compared to Australia (see Ubidy’s previous blog posts on this topic here).

To quantify this we took the recent Q2 Labour Market data from here and have summarised the 54 page report for Ubidy’s network. There are some surprising facts when compared to Australia and the results are as follows.

A Snapshot of Singapore’s Labour Market in Q2 2023: Stability Amidst Cooling Demand

Singapore’s Q2 2023 labour market report highlights continued stability in employment levels with incredibly low unemployment rates for both residents and citizens, a level of workforce security that might surprise many Australians. However, it also reflects a cooling in demand as external factors affect the economy. Here are the top highlights from the report, with some comments on the differences that may seem unusual to Australians, particularly regarding unemployment, workforce participation, and the sector-specific trends in Singapore’s unique economic landscape.

Exceptional Employment and Unemployment Levels

One of the most striking features of Singapore’s labour market is the exceedingly low unemployment rate, particularly when compared to Australia. In Q2 2023, Singapore’s overall unemployment rate sat at 1.9%, with 2.7% for residents and 2.8% for citizens. For Australians, where national unemployment has hovered around 3.5% to 4%, Singapore’s ability to maintain such low rates, especially for residents and citizens, is notable. Additionally, Singapore’s long-term unemployment rate is nearly negligible at 0.5%, indicating robust re-employment options, even in a cooler economic climate.

This low unemployment rate is partly due to Singapore’s labour market structure. The country has a strong reliance on foreign workers, particularly in industries such as construction and manufacturing. These sectors saw continued non-resident employment growth as they backfilled roles vacated during the pandemic. Singapore’s use of migrant labour allows for greater flexibility, particularly in roles less appealing to the local workforce, which contrasts with Australia’s more restrictive migration policies for non-residents in labour-intensive roles.

Seasonal and Sectoral Contractions with Strong Resident Employment Base

In Q2, Singapore’s resident employment declined by 1,200 jobs, a first since the pandemic’s initial impact in 2020. This dip was largely due to seasonal trends in the food & beverage and retail trade sectors. However, this is expected to recover in the next quarters, bolstered by events like the F1 Singapore Grand Prix and end-of-year festivities, which are projected to support demand for hospitality and service roles. Australians might find this level of predictability impressive, as it demonstrates Singapore’s strategic alignment of workforce needs with anticipated seasonal boosts, particularly within the tourism and events sectors.

Despite the slight contraction, Singapore’s resident employment remains well above pre-pandemic levels, underscoring a strong recovery since 2019. This long-term stability has kept resident employment healthy in sectors such as Financial Services and Community & Social Services. Meanwhile, the construction sector has seen a consistent reliance on non-resident workers due to the high labor demands that locals often avoid, a trend not as strongly mirrored in Australia’s more local-driven workforce structure.

Resilient Retrenchment Rates

Singapore’s retrenchment rates reflect another interesting contrast with Australia. Retrenchments decreased to 3,200 in Q2 2023, down from 3,820 in Q1, with restructuring as the primary reason. Notably, Information and Communications (I&C) recorded the highest retrenchment rate, driven by restructuring rather than economic downturn fears. Despite these retrenchments, demand in I&C remains high, with over 6,700 job vacancies. Electronics Manufacturing, another critical industry, saw retrenchments fall significantly, showing industry resilience.

This focus on restructuring, rather than outright layoffs due to economic conditions, illustrates Singapore’s proactive approach to maintaining industry relevance and adaptability. In comparison, Australian retrenchments often spike in response to economic shifts, such as rising interest rates or commodity prices. Singapore’s emphasis on restructuring suggests a nimble approach to workforce management, aimed at retaining a competitive edge in core industries like I&C.

Shifts in Labour Demand and Job Vacancies

While still elevated, job vacancies fell to 87,900 in June 2023, marking a fifth consecutive quarterly decline. Sectors traditionally reliant on external demand, like Manufacturing and Wholesale Trade, experienced some of the steepest drops in vacancies, at 46.5% and 50.9%, respectively. Despite this trend, Professional Services and Financial Services continue to create numerous openings, sustaining over one-fifth of all job vacancies in Singapore. This mix of high-demand, high-skill sectors contrasts with the more balanced sectoral demand distribution in Australia.

Furthermore, the ratio of job vacancies to unemployed persons, at 1.94, while lower than before, remains well above pre-pandemic levels, suggesting continued robust demand for skilled labor. Interestingly, fewer companies in Singapore indicated plans to hire, with only 58.2% looking to fill positions in the next three months.

Flexible Work Arrangements and Labour Turnover

Another significant aspect of Singapore’s labour landscape is its use of flexible work arrangements, which help mitigate the impact of economic shifts on workers. Although there was a slight increase in short work-week or temporary layoffs (810 workers), this level is still lower than pre-pandemic figures. Workers in Wholesale & Retail Trade were most impacted, alongside Manufacturing—a targeted strategy to minimize job losses.

Labour turnover rates remain steady, with a slight decrease in resignation rates, implying that workers are staying in their roles longer. Recruitment rates, especially in labor-intensive sectors like Wholesale Trade and Food & Beverage Services, exceeded the national average, suggesting that these sectors are still actively rebuilding their workforce post-pandemic. In Australia, high turnover rates are often cited as challenges in these sectors, and Singapore’s comparatively stable rates may be attributed to a combination of work visa dependency and deliberate workforce planning.

Key Takeaways for the Australian Context

Singapore’s Q2 2023 labour market report underscores a structured and adaptive approach to workforce management. With unemployment rates far below Australia’s and a strategic reliance on non-resident labour for specific industries, Singapore maintains labour stability even as demand cools. The country’s agility in managing retrenchments and re-entry rates, combined with sectoral reliance on flexible workforce strategies, suggests a model of economic resilience that could offer insights for Australian policymakers, particularly in managing labour demands in the face of fluctuating global conditions.

Based on the above, key differences with Australia include:

- Extremely low unemployment rates for residents and citizens that reflect a robust, highly skilled, and flexible workforce.

- A controlled reliance on non-resident labor, especially for high-demand, lower-skill roles, contrasting with Australia’s focus on local workforce and limited visa-based labor.

- Sector-specific workforce strategies, especially in construction and manufacturing, to maintain labour stability, a potential takeaway for Australian industries with high turnover.

Singapore’s labour market strategy in Q2 2023 points to a high level of resilience, strategic industry planning, and labour adaptability, setting a distinct contrast with Australia’s approach. This insight highlights the value of proactive labour management and cross-sectoral workforce planning to future-proof employment even in cooling economies.

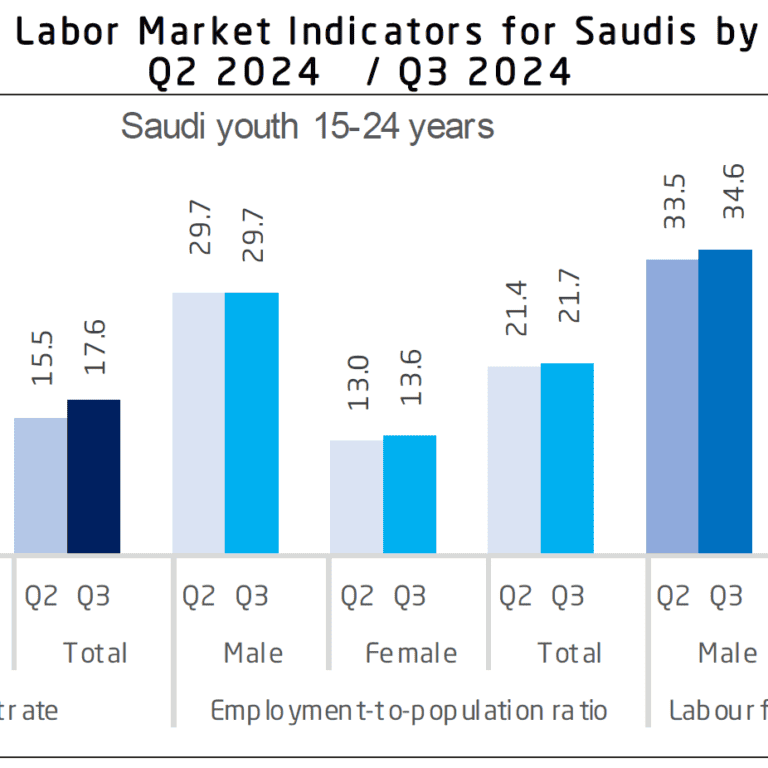

What Saudi Arabia’s Latest Labor Market Data Means for the Recruitment Industry

The third quarter of 2024 labour market statistics for Saudi Arabia offer a rich landscape of opportunities for recruitment agencies to support Saudi Arabia on its aspirational Vision2030 goals. With...

Read More

How will AI affect what talent sourcing teams are doing in three years’ time?

Since the launch of generative AI tools like ChatGPT and Sora, tech companies have been redefining the way companies source talent. New so-called agentic AI tools that allow AI agents...

Read More